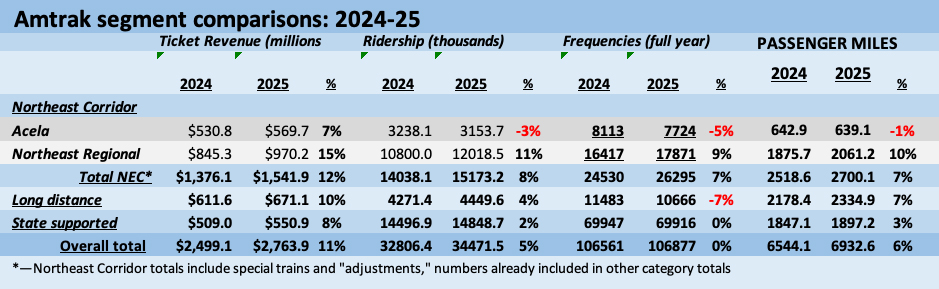

WASHINGTON — Amtrak ridership grew 5% in the fiscal year ending Sept. 30, 2025, and revenue surged 11%, as robust Northeast Regional gains offset fewer Acela frequencies on the Northeast Corridor. The railroad carried nearly 34.5 million passengers, while ticket revenue was $2.764 billion.

The results from the company’s monthly performance reports for 2025 are now posted on the Amtrak website. Compared with fiscal 2024, they show ticket revenue growing more than ridership in each category of service — Northeast Corridor, Long Distance, and State-Supported. This confirms what ticket buyers have experienced all year: fares are raised exponentially as coach seats and sleeping car space fill up. The higher fares allow the company to cash in on last-minute customers. [See “Amtrak has seats, rooms at higher prices …,” Trains.com, Nov. 7, 2025].

This strategy was recently criticized by New York Gov. Kathy Hochul, who secured a $99 price cap on fares between New York City and Albany-Rensselaer as part of an agreement to expand that route’s service [see “Amtrak, Metro-North to provide …,” Trains.com, Oct. 21, 2025].

It also indicates that strong demand could have fueled bigger gains if Amtrak had not been forced to withdraw the Horizon coach fleet from service for safety issues in March, or if management had been more proactive in returning sidelined Viewliner sleepers and Superliners to active duty.

Gains across the board

The table above shows “Ticket Revenue” rather than “Operating Revenue” to better portray an apples-to-apples appraisal, since the latter number contains more than $300 million of state payments to Amtrak. These vary by route.

Trains.com has also made no attempt to analyze “operating expenses” or “adjusted operating earnings.” This is because Amtrak’s opaque cost allocation process treats Northeast Corridor trains’ infrastructure allocated costs differently than those of state-supported and long-distance trains that largely operate over host railroads. State payments also depend on the type of equipment they lease from Amtrak and other factors.

Nevertheless, comparing years under the same methodology does show that on the strength of $85 million of Northeast Corridor gains and $34.5 million of net earnings improvement in the other two categories, Amtrak calculates a reduction in its annual operating loss from $705 million to $598 million.

The table does reveal some interesting details:

— The drop in Acela frequencies because of the increasing reliability issues with legacy equipment negatively impacted ridership, but revenue per passenger-mile (one passenger carried one mile) still increased.

— Northeast Regional patronage clearly benefited from more round trips and pricing flexibility, offering lower fares on off-peak trains than the fixed-consist Acelas.

— Long-distance frequencies dropped principally because the Floridian replaced the Capitol Limited and Silver Star, although the split between passenger-miles and ridership widened, an indication that more customers were taking longer trips. Note also how Amtrak’s inter-regional trains’ passenger miles are more than 85% of the Northeast Corridor total.

— Regional state-supported service showed no overall frequency growth because of trackwork cancellations and round-trip reductions in California, Michigan, and Maine’s Downeaster, but the other metrics improved.

Digging deeper

A closer look at the numbers yields additional conclusions.

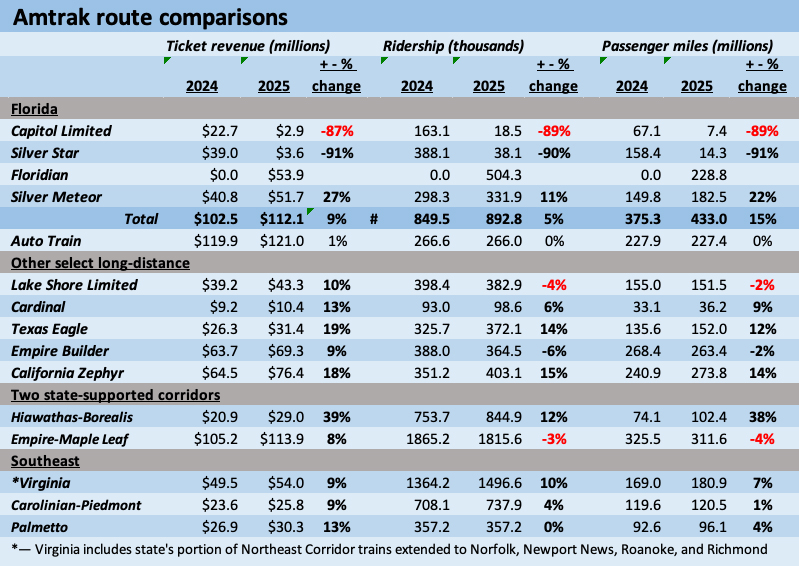

Florida shuffle

The Floridian, which combined the Capitol Limited and the Washington-Miami portion of the Silver Star on Nov. 10, 2024, has suffered significant timekeeping challenges. The latest example: Wednesday’s Miami departure left Washington 15 hours late on Friday morning, Nov. 14, after the train hit a dump truck in West Palm Beach. That said, combined passenger-miles and revenue of the new arrangement showed substantial gains, indicating longer trips. One of the reasons is increased coach capacity with single-level equipment on the Capitol Limited segment and strengthening of the Meteor’s metrics. It wasn’t necessarily Northeast-Florida market demand, because Auto Train patronage remained flat.

Positive and negative impact

Additional capacity — or lack thereof — played a major role in gains or losses for other long-distance trains.

— The Texas Eagle and California Zephyr benefitted from additional sleeping cars and coaches, racking up huge revenue and passenger-mile gains. [See “Texas Eagle lounge car set to return …,” Trains.com, Feb. 25, 2025]. The return of the Eagle’s Sightseer lounge also significantly improved the train’s onboard travel experience, perhaps facilitating positive word of mouth.

— The Lake Shore Limited lost a New York section coach, and its Boston section was converted to buses after a sinkhole closed Amtrak’s Post Road Branch east of Albany-Rensselaer. Higher fares clearly boosted revenue here, but the Lake Shore’s entire route seems ripe for another round trip on a daytime schedule west of Buffalo, N.Y., should Amtrak management scrounge enough equipment and make the effort to negotiate slots with CSX and Norfolk Southern.

— The Cardinal remains unnecessarily challenged as a triweekly train with limited capacity. Demand is strong, judging by the disparity between pricing and ridership, but it operates with only two or three coaches, one full Viewliner sleeper plus a baggage-dorm, and no Viewliner diner, even though management keeps enough of this equipment sitting on the sidelines to add to two trainsets. Through its checkered history, the train has done better and it can do so again.

— Empire Builder ridership may have been hobbled slightly by Borealis competition between Chicago and the Twin Cities, as well as lengthy delays and cancellations, but it also operated in peak season with only one Seattle coach. However, the train’s relative passenger-mile strength shows the customer mix shifted to longer-distance travelers.

Big gain versus contraction

— The Borealis-Hiawatha and Empire Service regional corridors are hardly alike, but they do offer an illuminating comparison, especially regarding the relationship between revenue, trip length, and passenger-mile growth. The Chicago-St. Paul, Minn., Borealis debuted in May 2024, so the October 2024-September 2025 numbers reflect year-long gains over the previous year’s four months. Note the jump in passenger-miles compared to ridership, and the impact of longer trips on revenue.

— In contrast, ridership and passenger-mile decreases for the Empire Service reflect the elimination of several Albany-Rensselaer round trips and other service deficiencies, such as combining the Maple Leaf with the Adirondack south of Albany.

Southeast growth

Neither Virginia nor North Carolina added frequencies in fiscal 2025, but the groundwork laid in previous years has aided additional public acceptance, as indicated by ridership gains propelled by local promotional activity and travelers’ willingness to pay more. Though categorized by Amtrak as a long-distance train based on an arbitrary 750-mile designation meant to preserve it without requiring South Carolina support, the single daily New York-Savannah Palmetto round trip generates plenty of passenger miles compared to its multi-frequency short-distance cousins, while being able to extract higher fares.

Attempting to dissect Amtrak’s year-end results provides a complex picture of the company’s disparate operations. The big takeaway is that passenger rail demand remains strong regardless of service, but utilizing assets to deliver more capacity will likely deliver even better outcomes.

— Updated at 9:09 a.m. CT to correct total ridership figure in first paragraph; updated at 11:10 a.m. to correctly position tables. To report news or errors, contact trainsnewswire@firecrown.com.

Amtrak’s market share is down, from one per cent down to one half per cent now.

Russ Sharp

I’m wondering how many realize that Amtrak’s market share has declined from one per cent to one-half per cent?

Russ Sharp

More power and best of good luck to Amtrak!

I will say I’m impressed that the Cascades managed to beat last year’s numbers given the Horizon fiasco, though not by much. 951k vs 941k. Right now the trains are running about three cars (two Amfleet coaches and a cafe), but apparently they’re still filling up. It ought to be interesting to see what happens when the new trains enter service and there’s more seats available.

And just consider how much more money amtrak could lose by adding capacity.

We might as well as add that Amtrak doesn’t want to operate trains in the winter as far as the Empire goes. Grew up near Fargo, went to school in Fargo and yes the winters can be fricking cold. But you literally operate differently when you know it is going to be -20 on a dead calm night and not going to get above 0 for a few days. You don’t throw up your hands and cry uncle. You put some effort to make sure things are running before hand, do extra to keep things running and do some more so you stay ahead of the cold..

But a shame, Amtrak has a real opportunity in a lot of places to make much bigger gains if a mentality lets get more cars on the tracks and running more reliable and more often. There is a demand out there as the analysis shows and what the market is willing to bear on pricing.

1. Run trains where people live while they are awake!

2. Don’t scrap Amfleet! Rebuild and get another decade out of them. Or, sell to someone who will and lease back as needed!

3. Do everything faster and better. Standard high level customer service for example. Still way, way too many horror stories.

4.

And here’s another example:

.

THE CARDINAL — AMTRAK’S ‘RED-FEATHERED STEP-CHILD’ —

Amtrak has never supported this train and has consistently treated it as a 4th-class route with tri-weekly operation and with minimal equipment, for decades. Over the past few years, Trains 50 & 51 have operated with one Locomotive, two Amfleet II Coaches, an Amfleet Dinette, a Viewliner II Sleeper and a Viewliner Bag/Dorm. Earlier this Spring, Amtrak announced it was adding a third Amfleet II Coach to the CARDINAL, boosting its seating capacity from 116 to 174 seats per train. However, after a few weeks, the third coach was suddenly removed and seating reverted back to 116 spaces for the entire Spring/Summer/Autumn travel periods. No explanation was ever given for the removal, but it’s widely known those two cars (one from each CARDINAL consist) were used to help launch the MARDI GRAS service, since those trains operate with 58-seat, long-distance coaches, instead of 74-seat, short-distance coaches, for the 3 hour, 43 minute trip.

.

As a result, the CARDINAL has operated SOLD OUT for virtually every trip since March. By offering only 116 seats, 1 accessible bedroom, 2 standard bedrooms and 15 roomettes (10 in the Sleeper, 5 publicly sold in the Bag/Dorm) the current space isn’t meeting demand. Not only does Amtrak refuse to add a third or fourth coach and an extra sleeper to open more capacity, and generate more revenue, but Amtrak refuses to restrict the ‘mini-corridor’ bookings on the Washington-Charlottesville and Indianapolis-Chicago segments that frequently block long-distance bookings on the CARDINAL. The Revenue Management Team should set computer ‘inhibitors’ on the WAS-CVS and IND-CHI segments to limit the number of short-haul riders, so as to keep seats open for long-distance sales.

.

Now that Amtrak is refurbishing Viewliner I Sleeping Cars, there are at least 6-8 Viewliner I sleepers now completed. Two of these cars could easily be added to the CARDINAL to offer additional, high-revenue capacity, since the lone sleeper on each train is always sold out weeks in advance. And, Amtrak has multiple Viewliner Dining cars sitting idle at Beech Grove, as seen on the YouTube video “Exploring Beech Grove Shops – November 2025”. Therefore, diners could also be added to the two CARDINAL consists and restore traditional dining car meals, while providing optimum viewing through the scenic New River Gorge and other mountain vistas of Virginia and West Virginia. Speaking of capitalizing on scenic views, Amtrak could find one more full-length dome car (added to the one it already owns) and put a dome on each consist, thereby offering “Dome Class” service (with upcharge fee) on the CARDINAL between Washington-Chicago. The domes could be added/detached with the engine change!

.

But Amtrak Marketing either (1) doesn’t think of these options, (2) doesn’t want to add cars, (3) doesn’t want to truly upgrade the on-board experience, or (4) only wants to charge more for the few spaces it offers. The METEOR, the LAKE SHORE and the FLORIDIAN routes are operating with 4 coaches, a lounge, a diner and 3 sleepers per train. The CRESCENT operates with 3 coaches, a lounge, a diner and 2 sleepers per train. Yet, Amtrak continues to hamstring the CARDINAL by severely restricting its assigned equipment and by forcing passengers to only travel three-days-a-week! Sadly, due to its highly-frequent sold-out status, many formerly repeat passengers have simply given up on trying to book space, knowing that each time they try, the CARDINAL is usually unavailable.

.

A ‘revised’ CARDINAL consist should mimic the CRESCENT —

Locomotive

Amfleet II Coach

Amfleet II Coach

Amfleet II Coach

Amfleet Lounge

Viewliner Diner

Viewliner Sleeper

Viewliner Sleeper

Viewliner Bag/Dorm

.

If Amtrak refuses to run the CARDINAL daily, it should at least ADD CAPACITY to carry more passengers on the days it actually operates and, thereby, generate more revenue and truly serve the passengers who want to ride.

A ‘revised’ CARDINAL consist with unique Dome Class added —

Locomotive

Full-Length Dome (added/detached at Washington with engine changes)

Amfleet II Coach

Amfleet II Coach

Amfleet II Coach

Amfleet Lounge

Viewliner Diner

Viewliner Sleeper

Viewliner Sleeper

Viewliner Bag/Dorm

Amtrak’s ridership is up, but on Western long-distance trains, it’s far from impressive when taken in context:

The Coast Starlight carried only 88% of the passengers handled in pre-Covid 2019, and operated much of FY2025 with only two coaches.

The Southwest Chief carried only 87% of the passengers handled in pre-Covid 2019, but with about 33,000 more patrons than in FY2024, it was able to reduce its “Operating Earnings” to a negative $81.7 million, down from just over (negative) $83 million the year previous. Negative Operating Earnings are otherwise known as operating loss, and this is according to Amtrak’s questionable accounting. Still, it’s interesting to note that while the Southwest Chief has only 88% of the route miles of the Empire Builder, its operating loss is 133% that of the Empire Builder, and by far the most of any Amtrak long-distance train. Clearly, the 270 or so miles of “passenger service only” between La Junta and Lamy (i.e. freight trains don’t chip in to cover the maintenance cost of the right-of-way) cement this train as Amtrak’s money pit.

The California Zephyr carried 98% of its pre-Covid passenger load in 2019. CZ ridership is bolstered by including that of the seasonal Denver-Winter Park ski train.

The Empire Builder is the poster child of how Amtrak knows how to kill ridership. Its FY2025 ridership was only 84% of pre-Covid 2019 at 364,500, and is simply pathetic considering the train routinely handled over 400,000 passengers in the 2000s and 2010s. Following an actual Amtrak equipment refurbishment starting in 2005 (not a “refresh” as Amtrak touts now), Empire Builder ridership ballooned to 554,266 in FY2008, the most of any Amtrak long-distance train….ever. In 2013, during the Bakken Oil Boom, ridership stood at 536,400. Since then, it’s been downhill. Amtrak has eliminated the amenities associated with the mid-2000s service upgrades, and lack of marketing has basically killed the once-lucrative ski business to Whitefish, Montana. As Bob stated, the Seattle section has been operating with only one Seattle coach in FY2025; In 2024, Amtrak dropped the second Seattle coach starting at the first of August – its busiest month. In 2022, Amtrak placed the train on its worst post-1980 schedule ever. It lengthened running time to accommodate the standard (why?) nearly one hour necessary to inspect and service the train in Minot, North Dakota (previously done in 20 minutes). The westbound schedule was set back nearly an hour (3:05 p.m. departure from Chicago) guaranteeing exceptionally unpalatable arrival times in St. Paul, Glacier Park, Whitefish, and Spokane. The equipment on the West Coast has the shortest turnaround time of any Amtrak long-distance train, and the 2022 schedule reduced turn time in Seattle by 49 minutes, increasing the likelihood of the eastbound train being delayed a late westward train inbound. This and additional schedule padding made for a later Chicago arrival time, severing connections for three trains, reducing ridership through lack of connectivity. 2022 was also the year that the Siemens ALC-42 Charger locomotives were first introduced in long-distance service, with the Empire Builder being the guinea pig. Needless to say, history tells us these units fared poorly versus winter in North Dakota (and pretty much any other time just because of what they are), yet Amtrak continues to operate the California Zephyr and Southwest Chief mostly with P42s. So, if you’re wondering how to kill over a third of the ridership on a popular long-distance service in less than two decades, follow Amtrak’s plan with the Empire Builder!

From around 2005 to around 2015, the consist shrank by two cars in the summer, from 11 Superliners summer peak to 9 Superliners.

The Floridian will never be a viable route. There is no reason why someone wanting to travel Washington to Chicago should wait for a train that might arrive any amount of time late from Miami. Just about anyone reading these pages would have told that to Amtrak.

On this past Friday, the Floridian due in Chicago that morning was projected twelve or thirteen hours late. Meaning travelers planning to make Chicago connections would be out of luck.

Just a surface-level observation, since the former Star’s route contains 3/4 of the Floridian’s station stops, most of which are on lower-trafficked and somewhat slower lines, a Palmetto-style train from DC to Tampa via Raleigh would make sense. The Floridian can double-cover 10 of the most-used out of those and operate express-style between Tampa and DC to keep schedule time consistent. Obviously it’s not a perfect analysis without trip creation data between points west of DC and the stops to be shifted to the theoretical DC-Tampa train, but the sheer amount of intermediate stops on the Star’s route really hampers how much time the Floridian can make up after a delay.

Correction, wherever that reads “Tampa” it should be “Miami”…