Why merge — and why merge now?

Those were leadoff questions last week at a virtual salon where four industry veterans dissected the forces behind Union Pacific’s proposed acquisition of Norfolk Southern, the untested regulatory road ahead, and the potential ripple effects for shippers, communities, and competitors.

Rick Paterson, an analyst with Loop Capital Markets, ran through the factors that led to merger talks between UP and NS.

The first is the lack of significant volume growth. Setting aside coal, over the past 20 years UP’s volume is up 5% and NS’s is up 9% in an economy that’s grown 50%, with industrial production up 13%, Paterson notes. Trucking tonnage, meanwhile, grew 40% over that span.

Some of the volume declines have been self-inflicted, Paterson says, due to a combination of periodic service failures, rate increases, and a focus on profit margins.

The second factor, Paterson argues, is fading pricing power. From 2017 through 2023, the Class I railroads achieved 2.5% average annual growth in rates — which was just half of the levels from 2004 through 2011.

“Pricing is no longer a driver of profit margin expansion,” he said during the The Freight Rail Transcon Merger Story—So Far: A Virtual Salon, hosted by independent analyst Anthony B. Hatch and trade publication Progressive Railroading.

Third, operating ratio improvement has stalled out. Both UP and NS had their best operating ratio years in 2021.

Put all this together and it’s a recipe for flat stock prices. When UP and NS stock outperformed the broader market and more than tripled in value between 2016 and early 2022, they and other railroads were the darlings of Wall Street, Paterson says. With stock prices flat for the past three years, that’s no longer the case.

“So this, at the end of the day, is the problem UP and NS are trying to fix,” Paterson says.

One remedy, Paterson says, would be to spend the money required to improve service, accept lower-margin traffic, and increase volume. But it would take years of stellar service to win back shippers who left for trucking.

“That’s a really, really tough thing to do,” Paterson says. “So are the railroads going to do that? Of course not. No way. That’s hard work.”

And so they are turning to a merger, a Hail Mary that brings cost and revenue synergies, Paterson says. “ Now, to be fair to UP and NS, if I was in their shoes, I’d probably be doing the same thing,” he says.

To those reasons for a merger, Hatch added President Donald Trump taking office in January — and the expectation that his administration would look favorably on railroad consolidation.

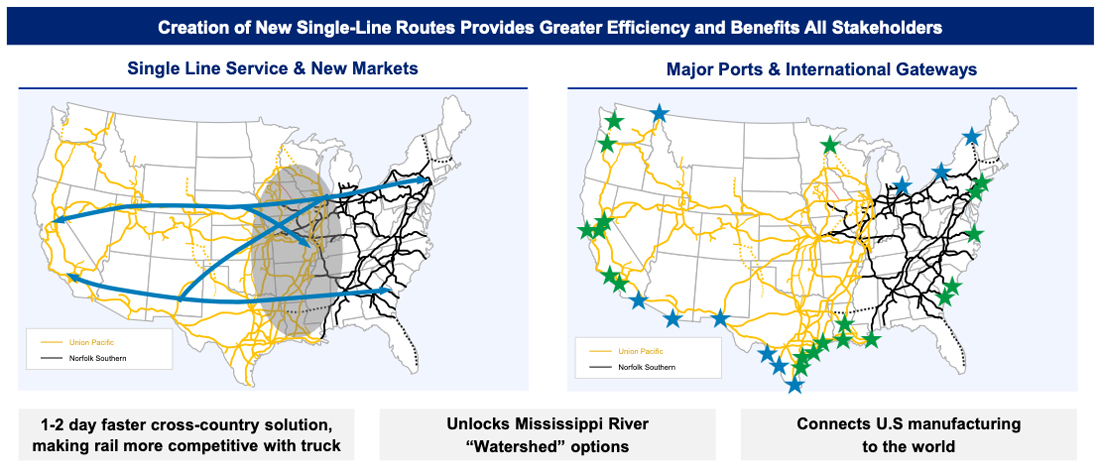

Benefits of a transcontinental merger, Hatch says, include coast-to-coast single-line service, faster decision-making, improved information technology, and the opportunity to gain new business from the so-called watershed area that currently involves two railroads for origins or destinations within a few hundred miles of the Mississippi River.

The Regulatory Road Ahead

The big question is whether the merger can pass regulatory muster at the STB and, if so, what sort of conditions the board might impose to preserve competition.

Roger Nober, who was chairman of the STB from 2002 to 2006 and later served as BNSF Railway’s chief legal officer, says the regulatory review of the merger is heading into uncharted territory because the review rules that the board drew up in 2001 remain untested.

The rules require the merger applicants to show that their combination would be in the public interest and enhance competition — two terms that have not been defined.

“There really isn’t any precedent as for what the public interest is,” Nober says.

In their merger application, UP and NS likely will argue that their combination will be in the public interest because they will be able to provide more efficient single-line service that reaches a broader range of customers and can help take trucks off the highway, Nober says.

“Enhancing competition, in many minds, is going to mean creating some kind of access remedy for shippers,” Nober says.

UP and NS have said their merger itself is pro-competitive and that no access concessions are required.

But shippers that operate facilities that are served by just one railroad are likely going to ask the board for access to a second railroad, whether through reciprocal switching, trackage rights, the choice of interchange gateways, or the elimination of bottleneck rates.

Nober cautions that “access remedies themselves are fraught with difficulty,” citing conditions imposed as part of the 1996 Union Pacific-Southern Pacific merger that have proven to be ineffective. “It’s very difficult to make those work and make those work well,” he says.

At a high level, Nober says the UP-NS merger brings up a philosophical question: “Does the benefit of size and scale outweigh the market power that size and scale give you?” Individual board members may have different views about that, he says.

Shippers are concerned that a transcontinental railroad will wield even more market power than today’s big systems, Nober says. Because of this, it’s likely that shippers who are served by UP or NS today will view the combined UP-NS system as a competitive disadvantage and seek remedies to improve competition, he says.

They won’t be alone in seeking concessions. Other stakeholders — including other railroads, Amtrak, commuter railroads, and communities — are likely to seek concessions from the railroads or the STB. “The agency and the merging parties are going to see a level of commentary that is heretofore unprecedented,” Nober says.

David Woodruff, a former head of U.S. public and government affairs at Canadian National, said trackside communities may weigh in with concerns about blocked grade crossings and the impact of longer trains. As a transcontinental merger, the UP-NS deal will affect more states and congressional districts than any prior merger, he noted.

The railroads have an opportunity to head off community opposition now, Woodruff says. CN ignited a firestorm of criticism from Chicago suburbs when it announced it would acquire the sleepy Elgin, Joliet & Eastern and boost daily traffic to two dozen trains, up from just three. Mitigation agreements, along with others imposed by the STB, wound up nearly doubling the cost of the 2009 transaction, Woodruff notes.

Unlike the CN-EJ&E deal, UP and NS have said that they don’t expect major shifting of traffic to different routes or gateways.

The board and other parties also are likely to closely scrutinize UP and NS’s volume growth claims, Nober says, given that projections in other mergers did not materialize.

If the merger is approved, Hatch said he expects BNSF and CSX to tie the knot. BNSF said this week that mergers are unnecessary and are likely to cause integration-related service problems. BNSF, CSX, CN, and CPKC all say they favor interline partnerships as a way to grow.

Hatch says those views will change if UP-NS is approved without significant conditions. BNSF and CSX, he says, would have a second-mover regulatory advantage after witnessing how the UP-NS review went.

Ultimately, Hatch says, CN and CPKC will join the merger party, leaving the U.S. and Canada with two go-everywhere systems.

Did PSR have anything to do with flat growth and earnings? Naaah.

Why merge — and why merge now?

Why merge? It’s profitable for the railroad and bank executives. In one word, greed. As a pleasant-sounding euphemism, “to unlock shareholder value.”

Why now? The easily flattered chief executive of the federal government who has no qualms about ordering regulatory agencies to serve his personal interest.

“Ultimately, Hatch says, CN and CPKC will join the merger party, leaving the U.S. and Canada with two go-everywhere systems.”

And if UP would acquire CPKFC (which would be most logical), look for Mr. Creel’s north/south “single line” route to be mostly abandoned or downgraded between the Quad Cities and Laredo in favor of superior (current) UP routes. Shreveport-Meridian would likely remain safe.

If now it is “too difficult” to win shippers back from trucks, why should it be easier with a merger?

James, Because they have run out of any other ideas how to run their businesses.

Macy’s could merge with Kohl’s, because neither company has any idea how to attract customers. Or Harley-Davidson could merge with Stellantis. Or Starbucks could merge with Spirit Airlines.