Analysts widely expect that BNSF Railway and CSX will seek to merge in the wake of last month’s announcement that rivals Union Pacific and Norfolk Southern would combine in an $85 billion deal to create the first U.S. transcontinental railroad.

“The question around BNSF remains not if but when they will announce a deal to merge with CSX,” Bascome Majors, an analyst with Susquehanna Financial Group, wrote in a note to clients.

BNSF’s corporate parent, Berkshire Hathaway, is sitting on a nearly $350 billion cash stockpile. CSX, meanwhile, reportedly has engaged Goldman Sachs to advise it on merger matters. Both railroads have declined to comment. And there’s no telling when the other merger shoe might drop.

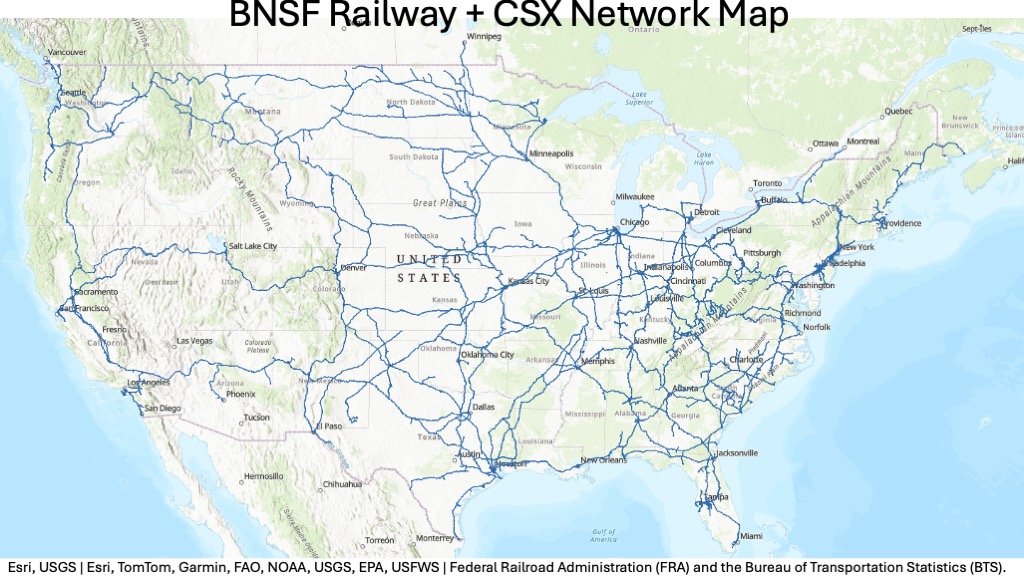

But if the Surface Transportation Board ultimately approves UP+NS and BNSF+CSX — an outcome that is far from certain — it would create two relatively balanced coast-to-coast systems.

How would the two transcontinental railroads compare?

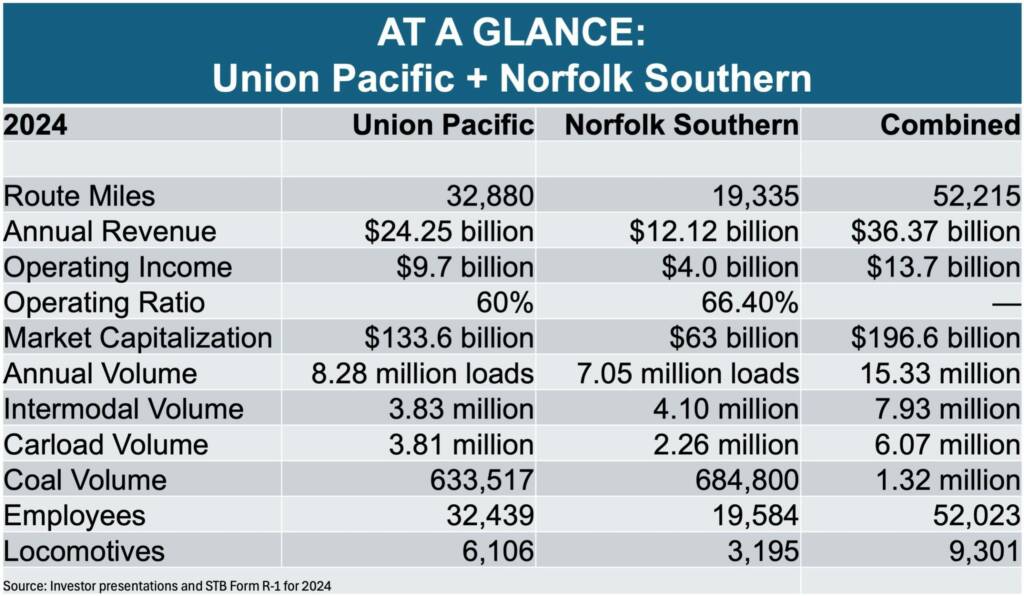

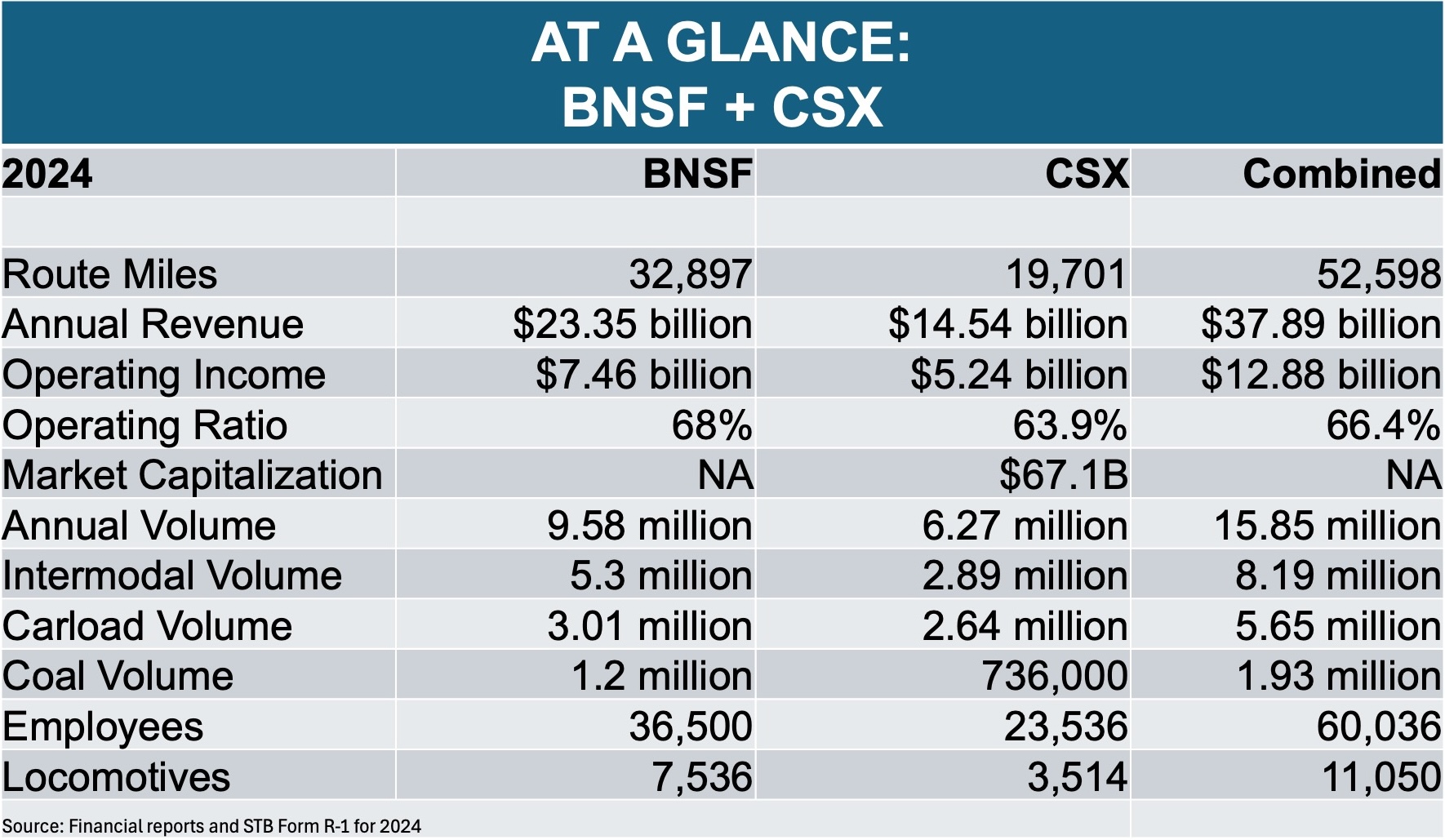

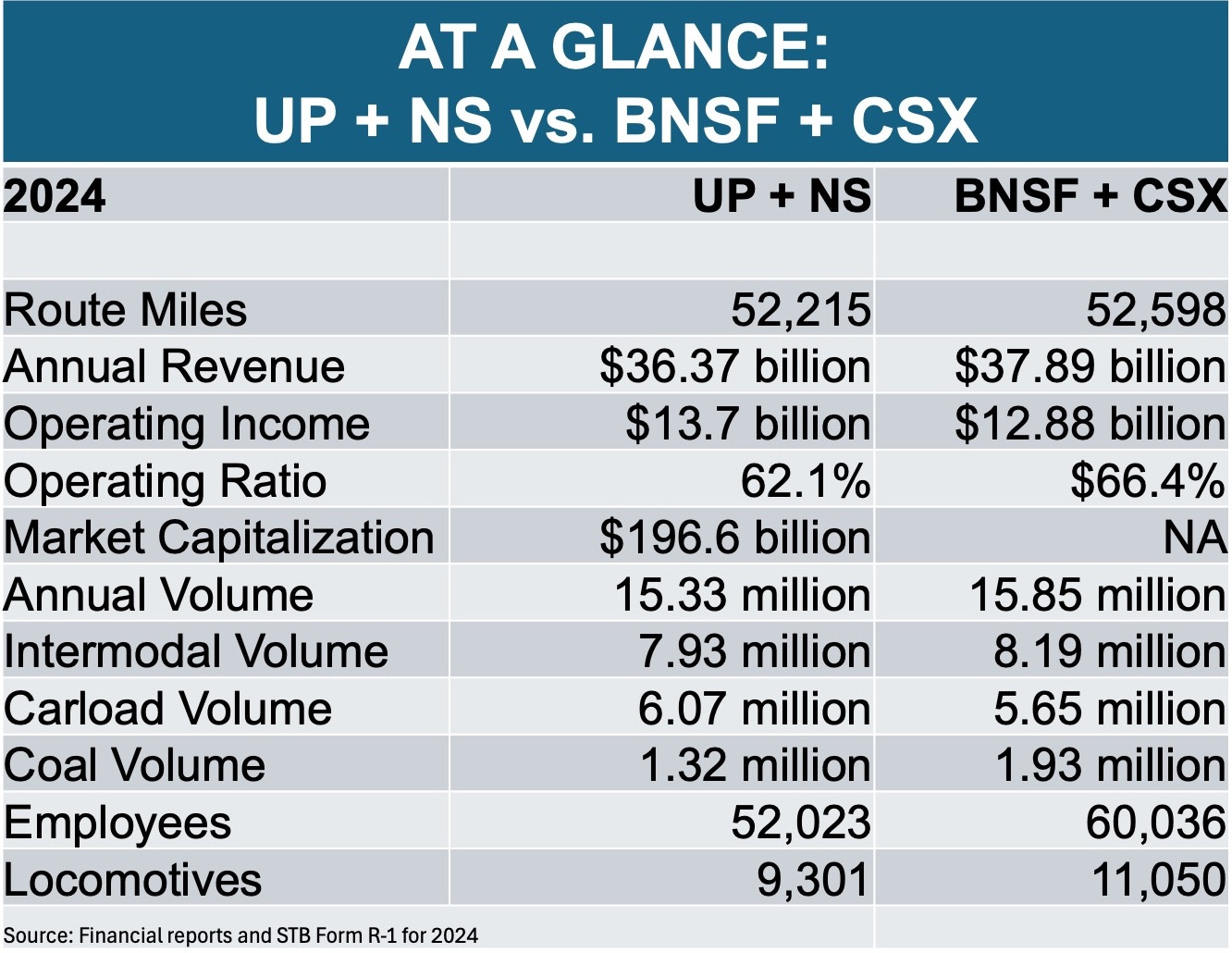

Measured by route miles, the systems are essentially tied at just over 52,000 miles. BNSF+CSX would be ever so slightly larger, with 0.7% more route miles.

BNSF+CSX would have 4% more revenue, based on 2024 financial results. But UP+NS would be more profitable, generating 6% higher operating income and producing a 4.3-point lower operating ratio.

BNSF+CSX also would handle more volume, including intermodal and coal traffic. UP+NS would have a larger carload network.

But the volume difference, based on 2024 data, is not huge: BNSF+CSX would hold a 3% edge over UP+NS.

BNSF+CSX also would have more employees and a larger locomotive fleet, based on 2024 data reported to the STB.

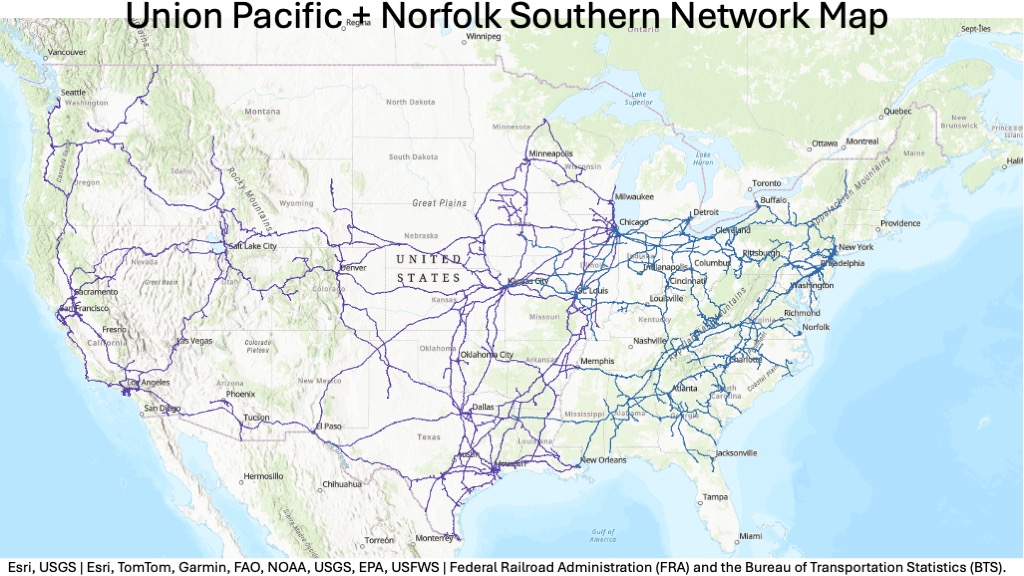

Geographically, the transcontinental tie-ups would still have the same holes in their maps as the current systems — unless regulators condition approval upon plans to fill the gaps in each network.

UP+NS would be absent from the Dakotas and have just a small presence in Montana, Florida, and New England.

BNSF+CSX would still have to rely on BNSF’s sparingly used trackage rights over UP in the Central Corridor that links Denver with Northern California, as well as the direct UP routes linking Houston with Memphis and St. Louis.

So, what happens with CN and CPKC under such scenario?

I guess CPKC would fit rather well with UP and NS, and CN would then tie-up with BNSF and CSX.

The opposite scenario would be more difficult to navigate. CPKC and BNSF do not integrate that well, with their only common interchange point in the West being the lightly used Sweetgrass, MT. Much more traffic runs to/from UP at Spokane.

Meanwhile, BNSF runs over CN and vice-versa in Vancouver, BC. BNSF also runs on CN between Emerson and Winnipeg.

In the East, CSX’s line between Beauharnois and Adirondack Jct is severed, preventing a link with CPKC’s Adirondack sub in Montreal. And CPKC rerouted its Detroit to Chicago traffic away from CSX’s Grand Rapids line in favor of the much faster NS through Elkhart.

“UP+NS would be absent from the Dakotas ” … sounds like a Feature, not a Bug.

The numbers certainly show the economic dangers of over-reliance on intermodal.

BNSF+CSXT could be named JBH+BNSF+CSXT. Would need a log locomotive to hold all that on its side!

we shall see but do not trust wall street

Bill,

With the central corridor and the directional trackage rights between Houston/Memphis and Houston/St. Louis trackage rights having now been in place for upwards of a quarter century, what have been the impediments to their utilization? By now, that should be clear, and a failed experiment from the Nineties could be made a successful experiment in the Twenties, could it not?

The railroads should divest themselves of the rails themselves outside of the yards. They can then operate over the entire network. Amtrak can manage them and all the Amtrak trains can carry along inspection equipment on the routes they choose to run. Other routes can be inspected in a similar fashion as to what they are already. The portions of the railroads that currently do maintenance can be either kept or spun off into a separate entity and they can bid on jobs along with other private companies the same way we do any other infrastructure like the interstate system. Major routes can be double tracked as well if not triple tracked where the need arises.

Then the rails can be ran similar to the interstate system, no more trackage right battles. And you can have the short lines operating just about anywhere as well similar to small trucking companies. Will there be some growing pains sure but basically make a FIFO (First In First Out) with Hotshot bidding for priority transit. Basically a train makes it to a certain point and is ready to go. They radio dispatch and are second on the list, they head out when the rest of the system is cleared unless someone has paid a fee to run a priority (Amtrak would automatically jump the line) load but the train length would have to be no more than 50 cars or something like that. Smaller companies who want to do priority loads can pay an extra dynamic fee to access ahead of the rest of the waiting loads but they would be able to get loads from point A to point B much faster than the average railroad would.

All the railroad companies would then pay a nominal fee per track ton mile similar to what their current costs are for maintenance and repairs based on how many cargo cars and how much they weigh. It would likely be similar to what they currently pay for maintenance costs anyway and they would be able to offset some of that based on maintenance tasks they perform if they opt to keep their maintenance equipment and personnel.

We could also use it as an opportunity to electrify all of the rails and run power lines in the right of way where needed and expand the grid. It would also encourage a move back towards a depot style system where trucks could be quickly dispatched for the last mile so to speak to make deliveries.

What would the railroad companies get for the tracks, honestly not much IMHO. Most of their tracks were built when they received land for free from the government over the years so why should they be paid for what they got for free in the first place.

Would there be some other issues that arise, I’m sure. But it would open the system up and allow them to merge to their hearts content (almost) because they would no longer have a huge monopoly over their given area’s.

You wasted your time here posting this pipe dream, because what you proposed will never happen.

You know how many BILLIONS of dollars it would take to electrify all the main line railroads? Where’s the money going to come from? The tax payers (again)?? If the railroads paid for it they will turn around and jack up shipping rates.

I’ll be blunt: NO SOCIALIZED FREIGHT RAILROADING IN THE UNITED STATES. PERIOD.

“Most of their tracks were built when they received land for free from the government.” If “Most” = 8%, then you’re right. Otherwise, the reality is that the vast majority of railroads weren’t built with land grants. And, most of the land grant railroads went bankrupt along the way. Of the 8%, the land dished out by the government was worthless because there was no way to move anything derived from having the land to a market. This was where the railroads came in, and they sold some of the land to provide the funding to build the railroad.

The rest of your post is without merit, too, but the “government providing land” always needs to be addressed because it’s the most-common misperception.

Spoken like a true socialist… There wouldn’t be any monopolies in ANY area. The New UP and whatever BNSF would call itself would dtill compete head to head just like UP.BNSF and CSX/NS do now. And their wre plety pf sjprtlines and regionals to fill in in the areas where they don’t. Plus, there is always trucks…

Two things stand out to me. One is if CPKC plays its cards right, it could benefit quite well, especially in the chemical traffic rich south Texas. Another potential stumbling block is if the STB insists on imposing reciprocal switching as a condition in some of these areas.

Sorry Alexander, The only way CPkc gets anything is the chemical south is if The STB mandates open access and reciprocal switching. If that happens, the deal is off and UP and NS go their separate ways. No American Class One is going to give up their rails for nothing. Since it was Keith Creel is pushing for it, since it costs him nothing, Jim Vena will respond by giving him nothing and killing the deal. Their will be no growth for CPkc for free. They might get a line or two sold to them but nothing is for free… Besides, since BNSFCSXRR will still serve much of the same area, there is no reason to give an outsider like CP any access at all. They don;t even have a decent way to get there or KCS would have already been serving the area…

Filling the Gaps Before They Become Craters

Bill Stephens’ breakdown of the likely UP–NS and BNSF–CSX transcontinental alignments is dead on the numbers — route miles, revenue, ORs, and locomotive fleets are all remarkably close. But the real story isn’t in the balance sheets. It’s in the gaps. And in what happens to them.

Two short lines stand out as potential game-changers in this new geography: Florida East Coast (FEC) and Iowa Interstate (IAIS). The FEC is in excellent shape and an obvious complement to a UP–NS system, plugging the Florida peninsula with a deepwater port network NS already knows well. IAIS, meanwhile, looks far more valuable in a BNSF–CSX construct, giving them a stronger bridge between Chicago and the Plains. These are not just “fillers”; they are potential choke points in a post-merger landscape.

And we can’t ignore the north-of-the-border factor: CPKC and CNR are not going to sit this one out. Their entry won’t be cooperative with each other, and their moves could reshape the map even further — potentially cutting into the symmetry that everyone assumes from the two U.S. megasystems.

Which brings us to the role of the Surface Transportation Board. If the STB approves these mergers without conditions, the “holes in the map” will become entrenched no-go zones for competition. The right move is not to leave gap-filling to corporate opportunism, but to redraw the national rail map before the ink dries. That means port-to-port corridors for the big two, and the divestment of redundant or captive territories to new regionals, short lines, or independents — not to other Class Is.

This isn’t just about network efficiency. It’s about restoring the other half of the bargain struck in the Staggers Act of 1980: intermodal deregulation in exchange for preserving the Common Carrier Obligation (CCO) in carload service. The FEC, IAIS, and other strategic lines operate in regions where shippers can quickly become captive. Without enforceable CCO standards — clear service metrics, transparent car allocation, and accountability — these mergers risk locking in monopolistic conditions under a coast-to-coast duopoly.

It’s worth remembering that companies like Union Pacific are not just private enterprises; they are creatures of massive public investment, land grants, and eminent domain rights. Their rights-of-way are still valuable today because the public endowed them in the first place. That history carries obligations — not just to shareholders, but to the national economy.

So yes, the financials of a UP–NS vs. BNSF–CSX contest may be evenly matched. But the real measure of success won’t be whose OR is lower in 2026 — it will be whether the STB uses this moment to prevent competitive deserts, reinforce the common-carrier covenant, and make sure the next 40 years of U.S. rail policy serve more than just two sets of corporate headquarters.

Again, Bill, as discussed … great article. However, two shortlines that come into this titanic struggle will be FEC (NS) and IAIS. Both of these railroads are in good shape and fill gaps. The FEC is the clearest target. The IAIS, based on your maps looks better in a BNSF system. Do not forget, though, that both CPKC and CNR WILL want in on this dance, and it won’t be to dance with each other.

Approval should absolutely be conditioned on filling the holes in both networks. Mergers are now required to increase competition, not just preserve it.

I don’t think BNSF will launch a proxy fight. CSX is just as good a prize and the $2.5 billion breakup fee is too high. The question is whether BNSF will go after CSX now or wait to see if UP/NS gets approved. What is the hurry?

BNSF/CSX will never merge with UP/CSX. The STB wouldn’t allow it. The question here is whether the 2 Canadian systems will join the 2 US systems.

BNSF waiting to see what happens is exactly the Warren Buffet/Greg Able game plan, if they merge at all. The “Omaha Oracle” is not about world dominance, never has been and never will be. He is about maximizing his dollars, Remember, BNSF occurred before his time. He just took advantage of it to buy it when the time was in his favor, not anybody elses. And then he took it private so no one, not the USG nor Wall Street could tell him how to run it. That is how he has made all his decisions. I know… I worked for a BHC entity and the same was true with us. There is no guarantee he even merges anything, Only if it is 100% in his favor and that of his shareholders, the few that there are… Never try to guesstimate what Warren Buffett will do. A lot of the time it is nothing…

You know that Berkshire Hathaway is mulling CSX or a proxy fight for NS. Depends on the regulatory winds.

WB is not going to pay 2.5 billion to UP to have a proxy fight over NS. If they were really considering merging, don’t you think BH would have acted first? You know that BNSF stands for ‘Buy Norfolk Southern First.” So why didn’t BNSF act first? They didn’t need to and still may not need to do anything. Everyone is assuming they know the mind of Warren Buffett… HAH HAH HAH…Good luck with that idea…

Your sub-header answers the question without the need for a deep dive. Ultimately, which transcon succeeds comes down to which business tenet – (quasi?) growth, or PSR – customers appreciate more.

Eventually executives and shareholders of UP+NS and BNSF+CSX will get antsy for bigger and quicker profits and look to merge. To paraphrase Vanderbilt: quality of service and the public be damned.

It will NEVER HAPPEN BECAUSE THEN IT WOULD BE A MONOPOLY. The Government will never let that happen as their are Anti-Trust Rules that would not even let it get started.