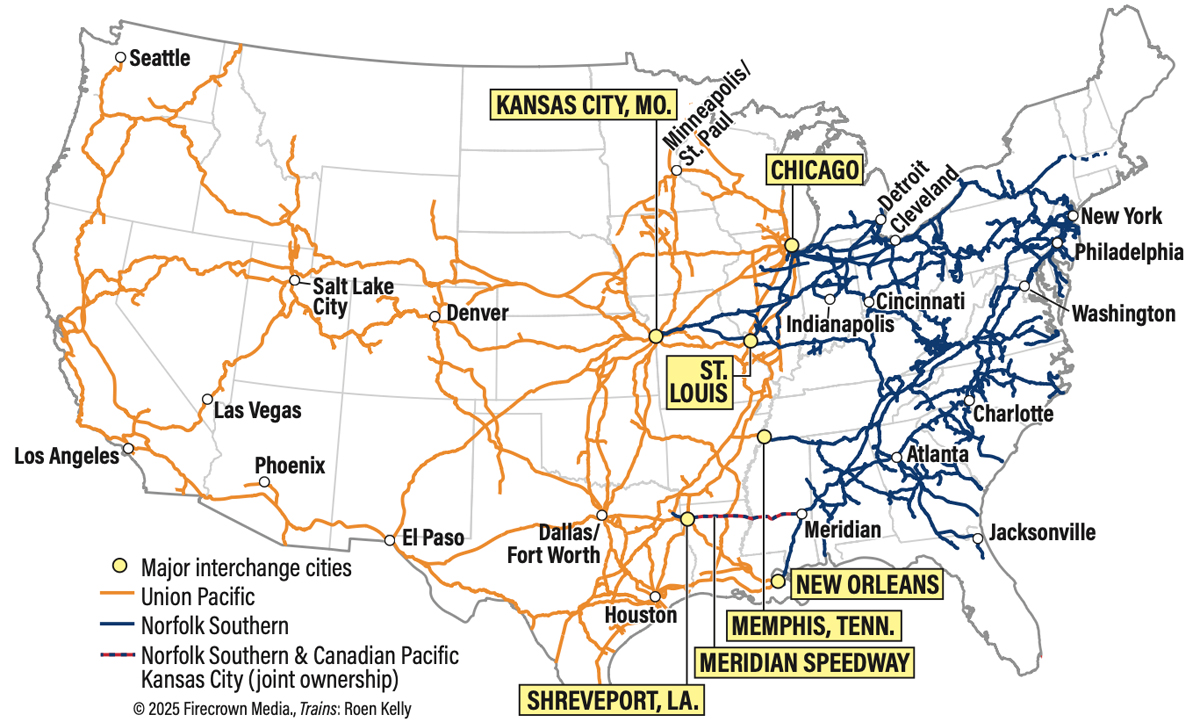

Union Pacific and Norfolk Southern today announced an $85 billion deal to tie their networks together and create the first U.S. transcontinental railroad.

The merged company — which will be called Union Pacific — will transform the U.S. supply chain and economy, strengthen domestic manufacturing, and preserve all union jobs, the railroads said.

UP will acquire NS in a stock and cash transaction that values NS at $320 per share, a 25% premium. The combined company would have an enterprise value of more than $250 billion. The railroads said the merger would create $2.75 billion in annual synergies within three years, through a combination of $1.75 billion in revenue growth and $1 billion in cost savings.

“Railroads have been an integral part of building America since the Industrial Revolution, and this transaction is the next step in advancing the industry,” UP CEO Jim Vena said. “Imagine seamlessly hauling steel from Pittsburgh, Pennsylvania to Colton, Calif., and moving tomato paste from Heron, Calif., to Fremont, Ohio. Lumber from the Pacific Northwest, plastics from the Gulf Coast, copper from Arizona and Utah, and soda ash from Wyoming. Right now, tens of thousands of railroaders are moving almost everything we use. You name it, and at some point, the railroad hauled it.”

The railroad will stretch 52,215 route miles, with track winding through 43 states from the East Coast to the West Coast and serving around 100 ports.

The combined company will deliver faster, more comprehensive freight service to U.S. shippers by eliminating interchange delays, opening new routes, expanding intermodal services, and reducing distance and transit time on key rail corridors, the railroads said. The merged railroad will shift freight to rail, reducing congestion and wear and tear on taxpayer funded highways, they added.

“Norfolk Southern, like Union Pacific, is a railroad integral to the U.S. economy, with a storied 200-year legacy of serving customers across 22 states in the eastern half of the nation,” NS CEO Mark George said in a statement. “Our safety, network, and financial performance is among the best we’ve had as a company, as is our customer satisfaction. And it is from this position of strength that we embark on this transformational combination. We are confident that the power of Norfolk Southern’s franchise, diversified solutions, high-quality customers and partners, as well as skilled employees, will contribute meaningfully to America’s first transcontinental railroad, and to igniting rail’s ability to deliver for the whole American economy today and into the future. Union Pacific is a true partner that shares our belief in rail’s ability to deliver for all stakeholders simultaneously, and we are excited for our future together.”

Vena, who will be CEO of the combined railroad, invoked President Abraham Lincoln, who created the Union Pacific in 1862 with the signing of The Pacific Railroad Act.

“This combination is transformational, enhancing the best freight transportation system in the world – it’s a win for the American economy, it’s a win for our customers, and it’s a win for our people,” Vena said. “It builds on President Abraham Lincoln’s vision of a transcontinental railroad from nearly 165 years ago and advances our Safety, Service and Operational Excellence Strategy. I am confident this historic transaction will enhance competition to benefit customers, communities, and employees while delivering shareholder value.”

Creating the transcontinental version of Union Pacific is overwhelmingly in the public interest, the railroads said, and will enhance competition, consistent with the test that will be applied in the review of the transaction by the Surface Transportation Board.

The companies expect to file their application with the STB within six months, in which the companies will describe how the combined rail network will provide safer, faster, and more reliable service and increased competition.

The board of directors of both Union Pacific and Norfolk Southern unanimously approved the transaction, which is subject to STB review and approval within its statutory timeline, customary closing conditions, and shareholder approval.

The companies are targeting closing the transaction by early 2027. The deal includes a $2.5 billion reverse termination fee.

They do not plan to use a voting trust, a common maneuver in prior rail mergers that allows the shareholders of the target railroad to cash out while the deal is under regulatory review. The STB rejected a voting trust in Canadian National’s ill-fated attempt to acquire Kansas City Southern under the board’s tougher 2001 merger review rules.

The combined company will be headquartered in Omaha, Neb., which has long been UP’s home base. The NS headquarters in Atlanta will remain a core location over the long-term, with a focus on technology, operations, and innovation, among other priorities, the railroads said.

Trains News Wire will update this story throughout the day. The railroads created a website, UP-NStranscontinental.com, to tout their deal.

— Updated at Aug. 1 at 12:25 p.m. CT with corrected system map.

That’s 85 billions that could have been invested in improving the physical plant, expand capacity and grow the business through good customer service.

And this is exactly why railroads will eventually fade into inexistence.

So if UP can spend $85 billion for NS to streamline (which really means firing people), then UP can solve the Chicago congestion mess with their own money.

No more crying to the Stats of Illinois, Indiana, Chicago, and federal tax payers for money that benefits the UP only.

It is about time this has happened. The efficiencies are obvious and some downsides are there but will be ameliorated in the regulatory process.

My question is what will BNSF, CKKCS and CN and CSX do next? This could get interesting.

Jeffery opined: “The efficiencies are obvious and some downsides are there but will be ameliorated in the regulatory process.”

Made me giggle; as if the “regulatory process” is going to fix anything.

Shirley, you jest.

Another view on proposed buyout of NS. Concessions. What will UP have to give up to get it approved. Can see it now.

(1) CPKS. They would want greater access to the CHEMICAL COAST (Beaumont/Port Arthur/Houston Galveston area. Also would want UP to double track capacity in this area. Can also see access to the old Rock Island Spine route from Minneapolis/St. Paul to Kansas city to bypass Chicago from mid Canada to Mexico. Also a better outlet from Detroit to Kansas City.

(2) CN at the very least would want better access from Detroit to St. Louis to shorten its route to the Gulf Coast. Maybe even access to areas around Atlanta, Cincinnati, & Kansas City.

(3) In a big grab I could see BNSF wanting full ownership of the Sunset Route from New Orleans thru Houston. More access to chemical plants in Houston. Possible full ownership of the old D & RGW and WP routes thru the central part of the country to shorten routes to the Bay Area (present Trackage rights are expensive). And for a real grab, because they already in Birmingham Alabama, maybe access to Atlanta and an east coast port (Jacksonville or Charleston).

(4) Lastly What would CSX want. Know it would be west of the Mississippi but where (thru Houston to Mexico? Kansas City?)

Any purchase/merger will cos UP a lot. Either financially, trackage or both. It will be expensive. The big question (after what the government says) will it be too expensive.

Regarding Paul’s Point (2), the railroad that desperately needs a better route west of Detroit isn’t CN, it’s CPKC.

5) METRA will want full ownership and dispatching of the METRA North and Northwest lines (ex C&NW, for those of you from outta town), and some mega-concessions of the METRA West line (also ex C&NW), perhaps ownership of, and dispatching east of the Proviso Yard, and some manner of inexpensive trackage rights west of Proviso. The West line is a problem, because west of Proviso, it is the ex C&NW freight main line west of Chicago, but needs to share the resources with METRA up to Elburn. They (UP) may also be required to help METRA with their extension to Rockford, and perhaps fix up then transfer the tracks up to Racine or even up to the new Mt. Pleasant industrial sector. (One can dream, can’t one?)

$85 Billion is a lot of money. Don’t think UP has that much cash on hand. To finance this buyout, UP will have to finance this through bonds.

Buffet financed it’s purchase of BNSF from the pocket change in BH bottom draw. This is a different ball game. UP has cash but NOT that much cash. If I remember correctly , when NS purchased it’s 58% of ConRail it had to issue at least $5 billion in bonds. Wouldn’t be surprised that at least $40 billion (if not more) will have to be financed this way.

If this is the case (in my personal opinion I am), most of the hedge funds will avoid this stock. Too much money going out in interest payments and not enough for dividends and stock buy backs.

And by the way I think this buyout has only a 1 in 5 chance of getting approved. Also think that NS would be a better match with BNSF (Map wise and more similar management styles).

Mr. Mangan “- It was OK for 4 yrs when the shoe was on the other foot though as I recall. Now it’s not? Typical!

Galen they can dish it out but they definitely can’t take it , hahaha.

… And voilà!

Dr. Güntürk Üstün

The “big” is getting even bigger… It seems that it’s not even a mega-merger, it’s an mega-acquisition.

Dr. Güntürk Üstün

I have no insider knowledge on this and frankly, right now, I don’t want it.

But I can’t help but think:

Jim Vena: “We’re buying NS for $85 billion.”

“Uncle” Warren Buffett: “$85 billion? Heh-heh. Watch this ….”

I’m disappointed that I had to scroll all the way down to comment #17 from Galen Riley for Trump Derangement Syndrome to rear it’s shrunken head; you people need to up your game!

If the rail industry, with UP being a prime example, had a positive track record in actual mergers, this might be a welcome combination. The past 75 years tell us that there will be a negative impact on shippers, receivers, employees and communities served. The meltdowns resulting from both roads pretending to be ready to merge their IT systems should be epic.

Don’t get upset Mr. Mangan. We had to listen to you far right MAGA BS for years now. It’s our turn so you’d better get used to it. LOTS MORE TO COME!!!!

Mr. Saunders – What private company would take over Amtrak when its competition is publicly funded? I realize the Repulsivican mantra is “if I don’t use it we don’t need it, but if I use I want everybody to help pay for it”. How about we take the hwy financial burden off the Govt privatize the interstates as toll roads then you will have to carry a coffee can of quarters or keep electronically refilling your EZ pass card? Your joyride won’t be as joyful then will it? Let’s privatize the air traffic controllers & TSA privatization will be much more cost effective & who needs more of those lazy govt workers anyway! Beyond safety regs the Govt doesn’t belong in transportation lets privatize it all for a level playing field & see who survives.

I could not agree with you more Mr. Riley.

Regarding privatization of passenger service, I don’t buy it. I’m no fan of Amtrak management but neither do I see any magic bullet if Amtrak is divvied up and spun off to “private” operators. Fact is, there is no such thing anywhere, not in America nor anywhere else, where anyone has covered their costs running passenger trains.

And don’t give me that “Brightline” stuff. It’s not been reported on this web site, but other web sites have reported that Brightline is not doing so well financially. No surprise to me, as there is no such thing as profit in passenger railroading. Simply doesn’t exist.

Brightline has its I-4 route because Florida DOT built it for them, on the assumption (per our knowledgeable John Rice) that Brightline would pay it back in the form of rent. Won’t happen. No passenger railroad anywhere covers its day-to-day costs so how in God’s name will Brightline pay for the construction of tens of millions of dollars of freeway median.

Passenger rail is tax-subsidized, whether its name is SEPTA, or Amtrak, or METRA, or MBTA, or NYCTA, or UK Network Rail, or Nederlanse Spoorwegen, or CalHSR, or anything else. Anyone who thinks Brightline (Brightline Florida or Brightline West) is any different is in a massive state of delusion.

Charles there you go contradicting yourself again. How many times on this site have you rejoiced at cutting Amtrak funding? Amtrak sucks as it is I agree. But to eliminate it to make it better is just plane dumb. What needs to happen is fare and equitable funding for ALL modes of transportation. But as long as Amtrak is used as a political football it’ll never happen.

CHRIS, you ask, how many times on this site have I advocated cutting Amtrak funding? The answer is this:

ZERO.

NONE. NADA. HASN’T HAPPENED.

If you actually read my posts, I have all along advocated subsidized passenger rail. There are certain people on this site, you and others, who wrongly think that because I’m a Republican I advocate cutting Amtrak or eliminating the LDs. The only subsidized rail system I’m against is CalHSR.

Please be considerate enough to read my posts before criticizing them.

“The companies are targeting closing the transaction by early 2027. The deal includes a $2.5 billion reverse termination fee.”

Ridiculous.

How much has been allocated to all the Congressmen, PUG’s, lobbyists, shake down groups, diversity groups, state commerce commissions, union led PAC’s, pension fund PAC’s, are there anymore that need to be paid off?

The Borg continues, resistance is futile!

First, I think that map needs to be updated. It appears to show NS owning the CPKC line between Chicago and Kansas City!

Second, I wonder if Metra, now in a dispute with Union Pacific, will be able to leverage anything out of the merger proceedings.

It shows NS running up the D&H line north of Mechanicville and ex-Erie west of Hornell. A pretty bad map.

It will be interesting to see if UP puts any competitive/public benefit initiatives on the table ahead of the merger submission or will it be what STB forces them to do.

Will UP settle with Amtrak on an OTP process that improves OTP and is enforceable. Daily Sunset Ltd.?

Will UP proactively offer trackage rights/line sales to CN and CP?

Similar vein will they announce any capital investments at the connection points to fulfill the promise of better service for transcontinental traffic?

Will UP add capacity to actually Midwest “Donut Hole” traffic or is that just talk? Or will they price away existing inter-Midwest traffic to free up capacity for longer haul traffic?

Is all the traffic growth/service improvement talk just platitudes or will it be business as usual, focus on cost cutting and yield growth?

Finally, will CN make a play for NS, creating all kinds of havoc?

“The railroad will stretch 52,215 route miles, with track winding…wait! That’s waaaay to much; can you imagine the capital costs in keeping that much rail in proper working order? Let’s pare that down to, oh say, 30,000 route miles or so. That’s a nice round number, pulled conveniently out of … the sky. Our shareholders will **love** that! Our unions, not so much, but then again, when have we ever made a decision based on what the **unions** want? OK, then…sorted!”

This is only the opening move in the game. Just because UP and NS are canoodling doesn’t mean they will marry, nor that BNSF and CSX will rush into each other’s arms. Watch for NS’s dowry to grow larger.

Somewhere, the ghost of Doc Durant is smiling.

Once upon a time Union Pacific announced their plans to acquire the Chicago Rock Island & Pacific RR.

UP buys NS and announces the first True Trancontiental, coast to coast railroad. BUT….. It hasn’t happened yet! And with all the conditions the STB is likely to lay on this deal like open access, reciprocal switching, major trackage rights and possible line transfers (like UP lines in Minnesota and Wisconsin-the old CNW lines) and concessions to shippers, it could become less of a benefit to the point that they say “we tried” … and give up just like the UP did to Rock Island when the ICC took eight years to approve what was basically a simple transaction… Time will tell…But if the UP and NS can’t become one, in an area where their is little overlap, then no merger will ever happen and that will be that…

the rock island take over was called off because it had taken so long and the rock was in the crapper that is why up called it off

Union Pacific – a good choice for the first transcontinental railroad then and now. Solid image, approved trademark, less legal fees.

This UP-NS transcontinental railroad merger (and possibly other similar mergers), quasi-monopoly, with all their reverse traffic double tracking, PSR, and PTC, needs to allow for a privatized high(er) speed passenger train system to operate along side their freight system. I could even imagine some slower scheduled passenger cars tacked onto the rear of scheduled intermodal fast freights.

I wonder if the UP has told the NS that they need to bend over in preparation for the changes coming as the UP did when they bought out the C&NW 30 years ago.

That happened when Ancora became the decision maker at NS…

Sarcasm on….

The new name will be, “US – Upsy daiSy.” Did we just melt down again? Or, “UPS – Uncle Pete’s Southern Rabbit Ranch.” Oh wait, there already is a UPS. Or, “SUP – Southern Union Pacific.” SUP, dude. Where is my shipment? Or, “PSA – Pacific Southern America.” Wait, wasn’t PSA was an airline that crashed and burned in San Diego. Or, “SNUP – Still Not Up to Par.” Wait, we’re still not meeting Wall Street’s OR of 30 percent.

Read the story… It going to be Union Pacific Rail Road. That’s what happens when one company buys another company. Doesn’t sound like NS was too worried about it. I am sure Ancora is jumping for joy as NS stock price took a big jump.

The PSA name still exists…as a connector airline to American…similar to American Eagle.

NSC is down $9.28, UP down $8 and change.

Vincent, get a friggin’ life. That was supposed to be humor.

I thought they would change the N (in NS) to: YOUR.

Then the new company would be called: UPYOURS!

Now if we can just find an individual or an entity with several billion dollars to create a company that can take over all of the Amtrak long-distance routes and operate and market a true, equalized-level of service on all trains! This will require congressional action to change the Amtrak corporate charter, but it can be done. The new company needs a group of executives and managers with knowledge and/or experience of railroad operations and passenger train marketing. Then completely upgrade every existing long-distance route to offer coach class, dome/scenic class, parlor-class and sleeping class with every train offering full dining car and lounge car service, and, with a sufficient number of cars to carry everyone who wants to ride. Trains offer something unique that airlines, ships, buses and autos don’t…….you can keep adding capacity by adding more cars as trains sell out. Simply program the reservation computer to add another car every time a particular train reaches the SOLD OUT point. Of course, having enough cars on hand will be required. Amtrak has had 54 years to provide viable and standardized service. It has failed. The existing former airline executives now running Amtrak are killing the long-distance trains. It’s time for another company, dedicated to preserving and expanding long-distance passenger trains, takes over and operates a service America will use!

The only way Amtrak ever works is if it becomes privatized company. Elon Musk got that right. Keep the quasi- federal mandates but let the road be run like a real railroad. Split the commuter (NEC) out of the Long Distance trains and let each corridor manage itself and it needs. If a Herzog, Vieola, Brightline and others can bid on the Amtrak System and run it like it needs to be run with the services the passengers want and will pay for, then it can be a successful enterprise. But as long as Amtrak only exists to make it leadership rich, then it will never be more that a train from A to Z run as cheaply as possible, like it is now.

The BlackRock types who had bought there way into NS are now cashing out, likely to put those funds into crypto. (cynical? ME??)

Next comes BNSF/CSX which could become BSX! Man, the possibilities are endless.

Or “SFX”

Union Pacific and Norfolk Southern are following my suggestion to adopt the name of the former, Union Pacific upon their proposed merger. The rail hubs of Norfolk, Chattanooga, Memphis, Cincinnati, Chorlotte, Atlanta, et al would see more trains pulled by armour yellow locomotives in the East and South.

The first literal transcontinental railway whose predecessors I grew up travelling aboard their passenger trains hopefully is materialising.

Well at least this “train wreck” will occur during dementia Donald’s term I’m sure they’ll be more mayhem to come.

Better tha under Slow Joe or Krackpot Kamala,,,,giggle…

“Better tha [sic] under Slow Joe or Krackpot Kamala,,,,giggle…”

Really? Why? Maybe because under their leadership, this would never even be a thought?

Too bad they didn’t decide on Pacific Southern, the name of our model railroad in NJ.

I just read a headline in the local TV station KIRO 7 Seattle. It says in the headline, “Union Pacific Buys Norfolk Southern to create 1st transcontinental railroad in U.S.”.

pardon I am from the uk and i thought the first was in 1869 so all the projects i did for college and others on power points were all based on a lie according to USA media.

Norfolk Southern becoming a fallen flag… who would’ve thought that could happen? (Yes, i know it technically hasn’t happened yet, I just thought I’d ask)

It actually happened in 1973 when the Southern bought the old Norfolk Southern. They kept the old NS alive as a corporation until when the new Norfolk Southern was being created and someone remembered. Some quick legal footwork was done to merge the old NS out of existence.

Hey, would Southern Pacific be a better name? Now BNSF and earlier BN won’t be the only transcon! Of course the Panama Railroad has had them all beaten since 1855 or ’59.

The same people who thought Santa Fe would become a fallen flag…

Didn’t the Southern Railway merge with Norfolk Western to create Norfolk Southern?

David, there’s the OLD Norfolk Southern Railway created in 1881 which operated in Virginia and North Carolina which ended in 1974. Then there’s the NEW Norfolk Southern Railway which you are familiar, created in 1982.

“On January 1, 1974, the Southern Railway bought the Norfolk Southern Railroad and merged it into the Carolina and Northwestern Railway, but kept the Norfolk Southern Railway name. In 1982 the Carolina and Northwestern name was brought back to free up the Norfolk Southern name for the planned merger of the Southern Railway with the Norfolk and Western Railway. The new Norfolk Southern Railway was formed in 1982. While the name had once represented simply the Virginia and North Carolina–based railroad which ran south from Norfolk to Charlotte, it was now a combination of the names of the two merged Class I railroads.”

@James. Thank you for the explanation. 1974 was just before I really started my railfan experiences.

OK Steve, “The merged company — which will be called Union Pacific —” What? no UPNS. (—grin—)

Nah, the UP can’t stand to make any homage to those which it has gobbled up. “It’s mine, I tell you! MINE!! So the name stays!”

And now, the entertainment from the self styled Trains commentary “Experts” begin………..

Which experts? I think you mean the opinionated. Entertainment, absolutely!