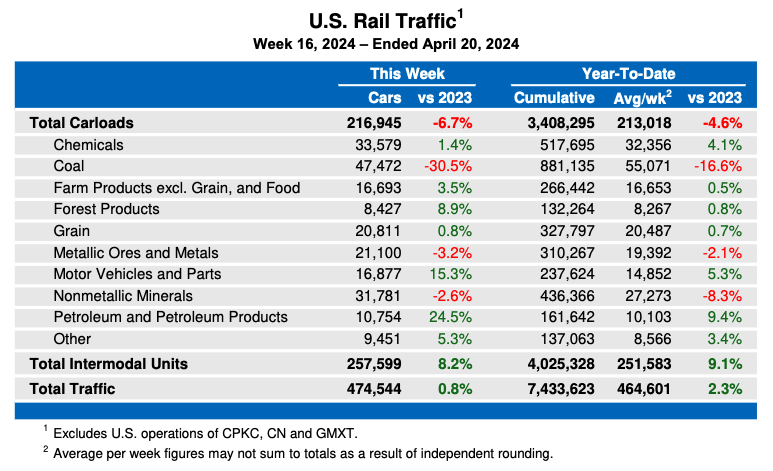

NASHVILLE — Union Pacific has trimmed its volume, productivity, and operating-ratio expectations for the year amid sluggish operations and a sharp decline in international intermodal traffic due to global supply chain problems.

UP now says it will see a 4% volume gain this year, down from the previous forecast of 5% growth; productivity gains will total $250 million, down from $350 million; and its operating ratio should improve 1.5 points rather than 1.75 points, Chief Financial Officer Jennifer Hamann told an investor conference Wednesday morning.

“The results still show that UP is going to be producing its most profitable year ever in 2021,” Hamann says.

UP is working its way through operational problems related to crew shortages. “Our crew availability is stressed due to the impact of COVID and the vaccine mandate, and the general sluggishness in our service product,” Hamann says.

UP is working its way through operational problems related to crew shortages. “Our crew availability is stressed due to the impact of COVID and the vaccine mandate, and the general sluggishness in our service product,” Hamann says.

UP’s performance metrics, including freight car velocity, dwell, and on-time performance as measured by trip plan compliance, are all below last year’s levels. The railroad’s intermodal network is fluid, Hamann says, but manifest and bulk service remain affected by lower train speeds and higher terminal dwell.

UP’s service metrics recovered slightly during the Thanksgiving week, when volumes decline and allow the railroad to catch up. “We want to hold on to those gains and build on them through the month of December,” Hamann says.

International intermodal volumes have fallen in recent months and in October were at their lowest level since February 2015, Hamann says. Although the ports of Los Angeles and Long Beach remain jammed, cargo landing at North America’s busiest port complex is being transloaded into domestic containers at higher rates than usual, which has hurt UP’s international intermodal volumes, Hamann explains.

UP has not seen a corresponding rise in domestic intermodal business. UP’s fleet of UMAX and EMP domestic containers are currently maxed out due to chassis shortages, Hamann says, and the railroad even has some containers still in storage because of limited chassis supply. Customers are taking longer to unload and load containers due to tight drayage supply and capacity constraints at warehouses.

Overall, UP’s intermodal volume is up 4% for the year, but is down 14% for the fourth quarter to date as volumes decelerate.

The global shortage of computer chips also has curbed automotive production and UP’s finished vehicle volumes, which are down just 1% for the year to date but 17% so far in the fourth quarter.

UP, which has a 26% stake in Ferromex, has no plans to acquire the largest Mexican railroad as a competitive response to the proposed Canadian Pacific merger with Kansas City Southern.

Corporate parent Grupo Mexico is happy with the current Ferromex ownership structure, Hamann says. “Our long term plans with the FXE is just to continue to grow that partnership and do business development and make sure that we work very collaboratively with them,” Hamann says.

“They run a great railroad,” she adds.

UP’s Mexico cross-border traffic, which represents 11% of UP’s overall volume, is split evenly between Ferromex and Kansas City Southern de Mexico.

Hamann spoke with analyst Justin Long at the Stephens Annual Investment Conference.

How is UP doing in the “Great Resignation” department? Does it have anything to do with train crew availability?

UP intermodal volumes decreased due to trucker restrictions at the ports. No trucks, no trailers (chassis), no trailers then dock is obstructed. Dock obstructed no loading on rail except by direct from crane. These restrictions at Long Beach/LA were not removed until 2-3 weeks ago by Gov. Gavin Newsom.

It will take another 2 months of trucker availability just to clear the stacks upon stacks of containers waiting to depart the port. Then there are the average of 10-15 container ships *just waiting* to dock.