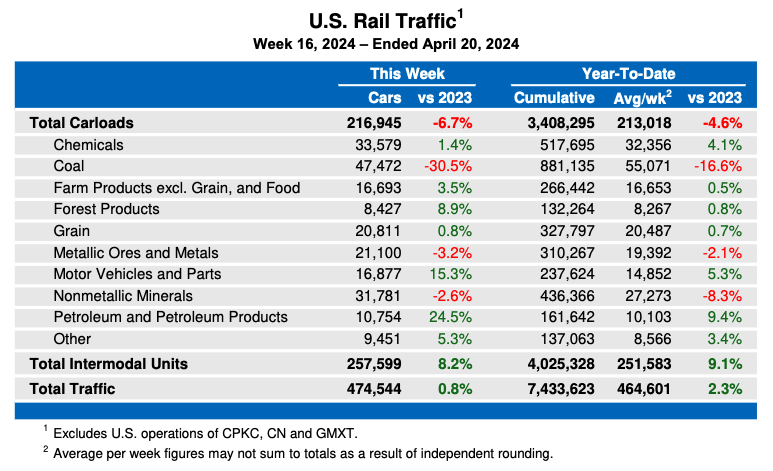

CHICAGO — U.S. Class I railroads continue hauling more chemicals than before, an area of growth even though higher interest rates are raising fears that the U.S. economy could begin contracting. Railroads’ diverse chemicals portfolio supports manufacturing, automotive, energy, and a hodgepodge of other industries, indicative that growth within this carload segment is generally a positive sign of the economy’s health.

This year, U.S. railroads have transported 1.27 million carloads of chemicals, up more than 3%, or 41,000 more carloads than a year ago. Chemical carloads, railroads’ highest carload volume segment besides coal, has largely outpaced 2021 volume. But the Fed’s continued focus on taming inflation by increasing interest rates runs the risk of curbing economic output and stunting chemicals’ momentum in carload growth. Interest rates are currently 3.25%, up 3% from a year ago.

According to the American Chemistry Council, the U.S. Chemical Production Regional Index was flat in August after marginal growth of 0.2% in July. Last month, chemical production was flat across all U.S. regions, except the Gulf Coast, where production was down 0.3% year over year.

The council’s recent trends in manufacturing production cite gains in coatings, adhesives, consumer goods, fibers, synthetic dyes and pigments, and industrial gases. This is offset by weaker demand for plastic resins, organic and inorganic chemicals, synthetic rubber, and crop chemicals and fertilizers. Commodity analysts attribute the decline in the latter categories to a slowing economy, adequate inventories, decreased export demand, and lower feedstock costs.

To measure the economy’s strength, the council maintains a running tab of 20 various macroeconomic indicators and as of Sept. 23, nine of those 20 indicators pointed to a positive economy.

The diversity of railroads’ chemical business makes it a resilient carload segment with specific railroads benefitting or disadvantaged, based on their proximity to industrial and manufacturing hubs. Union Pacific hauls more chemicals than any other Class I, having moved 746,271 carloads year to date, up 7%. Chemicals at BNSF Railway are up 1% at 343,518 carloads; CSX up 0.3% at 396,718 carloads; and Norfolk Southern down 2% at 291,660 carloads.

In a perfect world, the Fed’s rate adjustments will slow inflation without tipping the economy into a major recession, allowing railroads to continue building on carload momentum. The Association of American Railroads notes that U.S. railroads celebrated their best month ever for chemicals earlier this year, building on the 2.2 million carloads moved across the rail network in 2021.

Included in the AAR’s chemicals commodity group is ethanol, soda ash, caustic soda, urea, sulfuric acid, anhydrous ammonia, plastic resins, and agricultural chemicals, among others.

Part of the reason why chemicals are the most resilient type of carload traffic is that in many instances they are “captive shippers.” Meaning it only makes economic or logistical sense to transport them by rail.