WASHINGTON — Canadian National, which lost the battle for Kansas City Southern to rival Canadian Pacific last year, tried to plant seeds of doubt about the CP-KCS merger in lengthy testimony before federal regulators on Thursday.

CN was critical of the operating plan CP and KCS prepared, telling the Surface Transportation Board that it was based on data flaws that were so serious that regulators should call into question the entire merger.

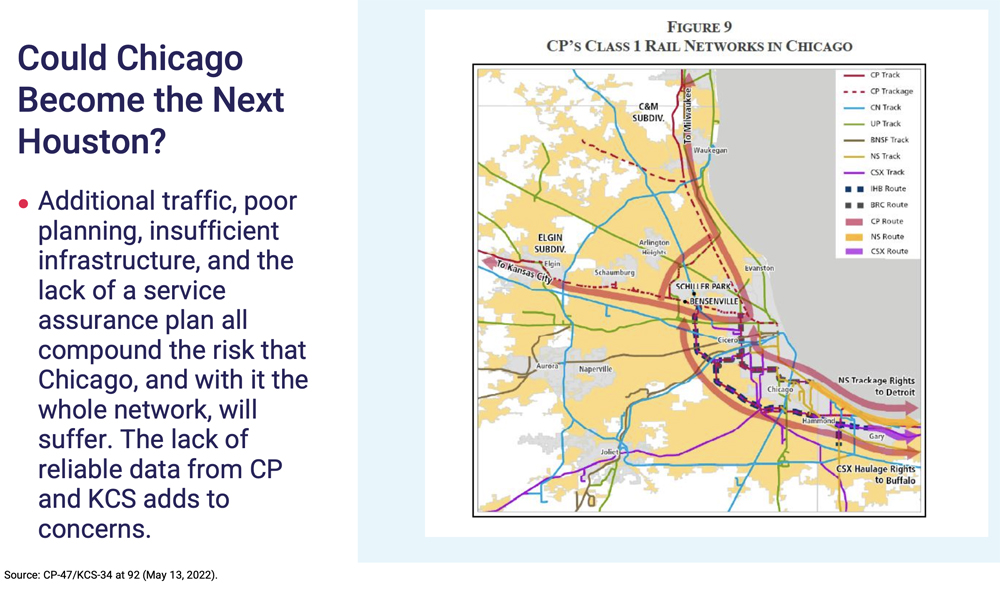

CN said that CP and KCS didn’t provide traffic data for some line segments that would be affected by the merger, such as on CN and Metra trackage CP uses in Chicago to reach Schiller Park Yard, while offering inconsistent volume and tonnage data for other line segments.

But board member Patrick Fuchs questioned how line segment data would make a difference in the STB’s overall review of the merger. He also asked CN to provide examples of how the board might impose a condition based on CN’s preferred traffic numbers instead of CP’s data.

CN couldn’t come up with an example, but said the data inconsistencies can’t give the board confidence that CP and KCS can successfully implement their operating plan.

Issues if CPKC achieves growth — or if it doesn’t

CN said the CPKC merger could go one of two ways — and either scenario would spell trouble for other Class I railroads and their customers.

First, CN said there was a risk that if CPKC did achieve traffic diversions at projected levels, the merged system would choke on its growth. CP and KCS say after year three of their merger they expect to grow tonnage by 20%, but CN points out that CPKC plans on handling that growth with only 5% more train and engine crews and a locomotive fleet that’s only 1% larger than current levels.

CP and KCS currently interchange three trains per day in Kansas City, the only places their networks touch. But CN claimed that merger-related traffic increases would melt down the fragile Houston terminal, Chicago, and the rest of the rail network because CPKC is unprepared for operational problems and is ignoring potential bottlenecks.

Board member Karen Hedlund asked how adding eight CP trains per day west of Bensenville Yard would create congestion issues in Chicago, a terminal that handles hundreds of trains per day. CN Chief Operating Rob Reilly said increased CP volume could have an impact at specific points, including between Bensenville Yard and Schiller Park Yard, which CP reaches via a combination of Metra and CN trackage.

Second, CN said that it was possible that CPKC would not hit its merger synergy targets. CN doubted CP and KCS operating savings projections. CN said CPKC’s 57.5% operating-ratio target — well below their combined 65% operating ratio from 2015-2019 — indicated the railways would slash costs. And CN questioned whether CPKC could divert traffic from other railroads at a projected 30% operating ratio when the merged railroad’s routes are an average of 217 miles longer than existing single-line routes.

A failure to meet traffic volume and financial targets, CN claims, will then force CPKC to strangle interchange at the Laredo, Texas, border crossing and other important gateways in order to force traffic diversions onto the merged railroad.

Fuchs asked CN what its operating ratio target was for 2022 in the wake of layoffs it announced last fall in a bid to cut costs. The answer: 57%, a half point below CPKC’s projected figure that CN had criticized.

Fuchs also asked what the last end-to-end merger was, whether it produced significant operational savings, and whether the railroads submitted a service assurance plan. CN pointed to its own 1999 merger with Illinois Central, which generated operational savings and went smoothly despite the lack of a service assurance plan.

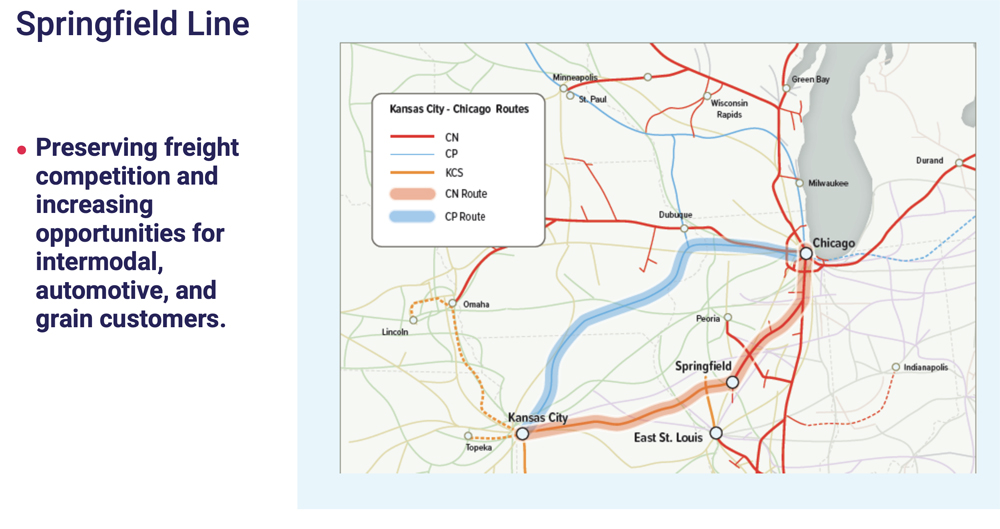

Skepticism over bid for Springfield Line

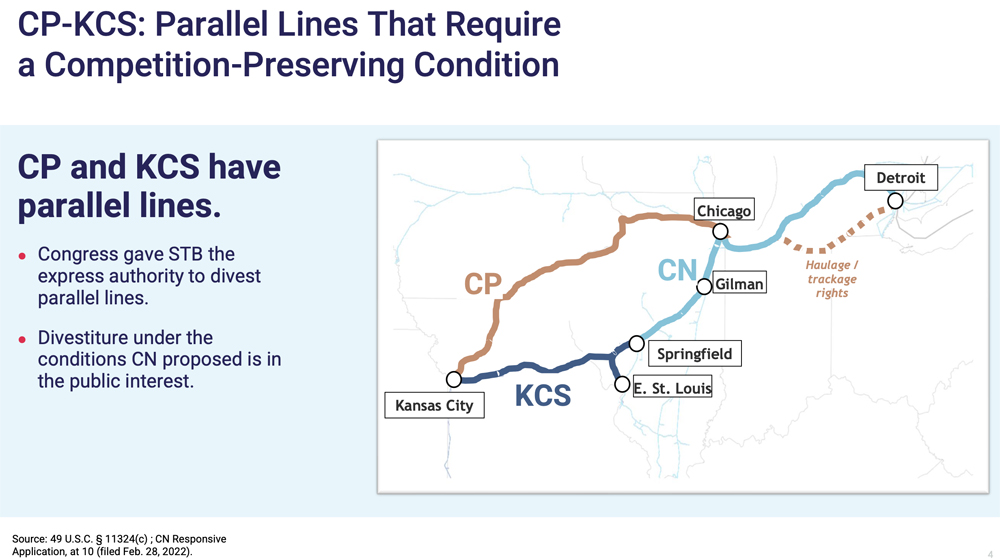

Board members appeared skeptical of CN’s bid to have the STB order CP to divest the KCS Springfield Line, which links the Illinois capital with Kansas City and St. Louis. CN envisions investing $250 million to create the Springfield Speedway, a single-line intermodal and automotive route linking Kansas City and St. Louis with Chicago, Detroit, Toronto, and Montreal.

CN contends the former Gateway Western trackage could compete with CP’s own main line from Kansas City to Chicago and that having parallel routes under the control of a merged railroad was anti-competitive. Under CN’s proposal, CPKC would retain access to all current and future customers on the former Gateway Western trackage through haulage rights.

CN says its ownership of the line would boost competition, take 80,000 trucks off the road annually, and add resilience to the supply chain by providing automakers with alternative railroad connections — all broad goals the STB supports and should welcome.

“I would,” STB Chairman Martin J. Oberman said. “But I’m also trying to assess the fairly dramatic relief you’re asking for, for us to deprive people of property they’ve bid for.”

Oberman asked if there was something short of divestiture of the line that the board could order as an alternative.

CN said ownership of the line was crucial because it was the only way for CN to make necessary investments to add and extend sidings and increase track speeds on the route. CN had a long interest in improving the line and linking it with its former Illinois Central to Chicago but never approached KCS about it until beginning merger talks last year.

Oberman questioned CN’s motives. “Where was CN three, four, five years ago if this was such a great plan of approaching KCS and offering them a bundle of money for this line or some kind of joint venture where both people could make money?” he asked. “This proposal strikes me, quite frankly, as reactive rather than something CN figured out would be good for the world.”

CN lamented the permanent loss of the Springfield Line as a competitive alternative, said it had tried to work with KCS on interchange at Springfield, and that the railroad landscape has changed over the past five years.

“What’s changed is that CP seems to have won the bidding war with CN for KCS,” Oberman said. “And now you’re here trying to ask us to force a deal that you have been unable or unwilling to make with KCS over the years up until now — and you’re taking advantage of the fact that there’s a merger application in front of us to obtain something that you couldn’t obtain in the private market.”

CN countered that it’s not a question of whether it should have worked out a deal with KCS years ago. The question, CN said, is whether it is in the public interest to force CP to divest the line.

Other board members suggested that ordering divestiture of the Springfield Line would be regulatory overreach.

“I appreciate that your proposed divestiture would be of enormous value to you,” Hedlund said. “What I am concerned about is that it seems disproportionate to competitive harm that may arise from this, if any.”

Fuchs noted the board prefers narrowly tailored solutions rather than ordering significant structural changes to the rail network.

The hearing on the CP-KCS merger will continue on Friday and, because of the slow pace thus far, will extend into an extra day on Monday.

Sounds like the Board is asking some probing questions that are poking large holes in CN’s arguments

And CN swallowing up Illinois Central, Wisconsin Central, DMIR, and BC Rail didn’t?

Whatever happened to the Schillerville(I think)-Gary, In interchange fight? CN & CP were having a while back?

“Where was CN three, four, five years ago if this was such a great plan of approaching KCS and offering them a bundle of money for this line or some kind of joint venture where both people could make money?” STB mic drop.

This is way too tedious and boring. Wash, rinse repeat. I can just picture the brainstorming sessions, with the CN lackeys throwing out disingenuous ideas to present to the STB, hoping to impress their own boss but having no impact on the merger. Idiots!

Get over it, guys & gals. You lost, now move on.

But if you give us KCS everything will be just fine! Have to agree with Charles this thing with CN is getting old just because there not getting there way.

Can you spell “sour grapes” boys and girls? I think the answer is CN!

The referenced Springfield line–is that the old Wabash line from Springfield & Jacksonville to Hannibal and on to Kansas City?

Former Chicago & Alton.

CN has gone downhill from irritating, to just plain tiresome. Yawn.