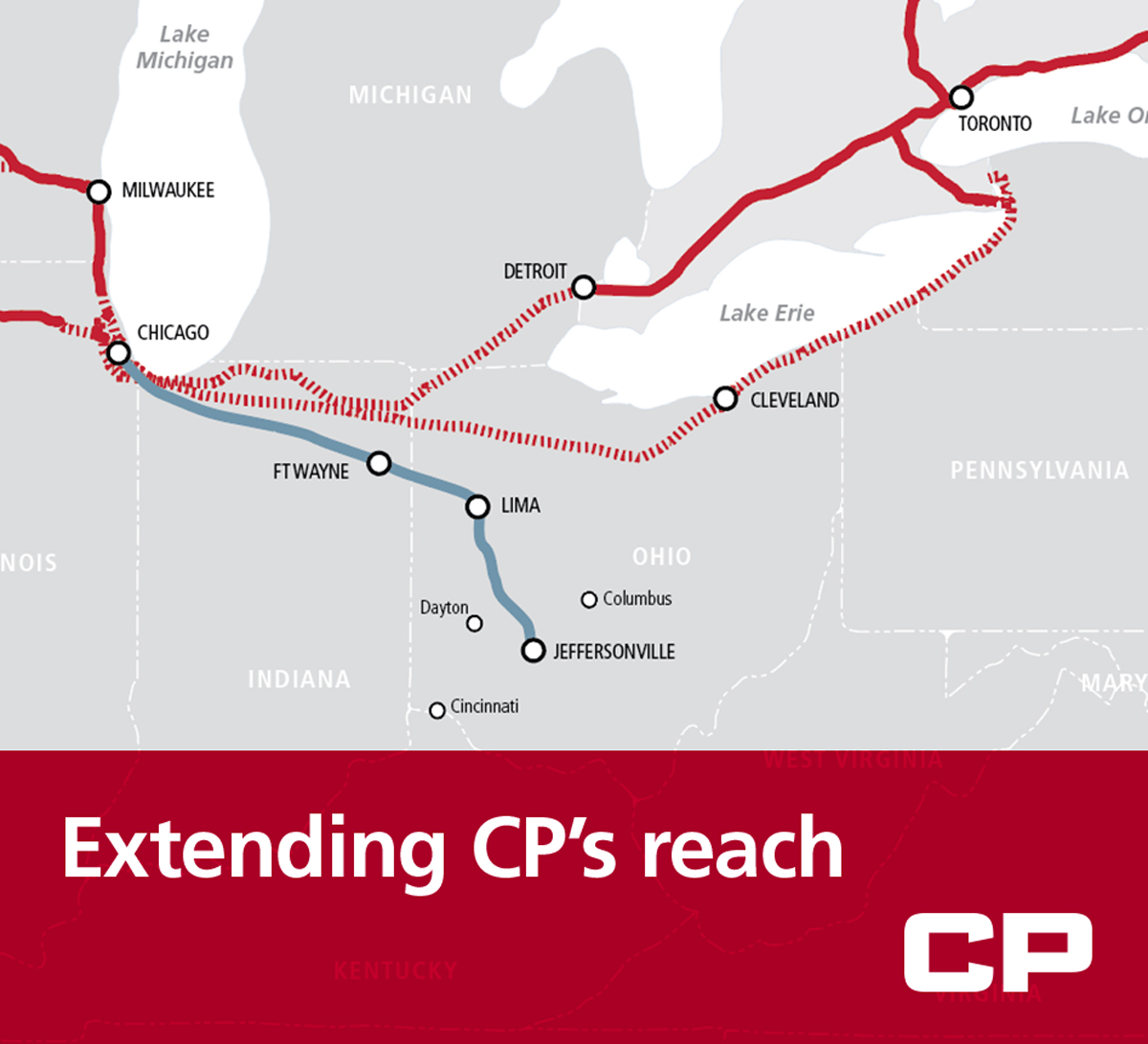

The Chicago, Fort Wayne & Eastern Railroad and the Indiana & Ohio Railway will provide CP with a route from the Windy City to an intermodal terminal in Jeffersonville, Ohio, which is within easy striking distance of Columbus, Cincinnati, and Dayton.

“This service allows our international intermodal customers to come through the Port of Vancouver and access markets deep in the Ohio Valley,” CP CEO Keith Creel said in a statement on Monday. “The unique site also creates better round-trip economics for our customers by enabling the empty containers to be re-loaded with agriculture products and shipped back overseas.”

The 90-acre terminal is owned and operated by a corn and soybean producer, Bluegrass Farms of Ohio.

International containers — which come to North America filled with consumer goods — often return to Asia empty. But North American farmers have seen growing demand for exports to Asia, and the empty containers represent a welcome opportunity for shippers, steamship lines, and railroads.

“This intermodal terminal not only offers a new rail option to and from the Ohio Valley, but was purpose-built to provide backhaul opportunities that will enable customers to reduce overall transportation costs and enhance their competitive advantage,” G&W CEO Jack Hellmann said in a statement.

It was not clear when the service would begin or if it would be operated in dedicated run-through trains. A CP spokesman declined to provide additional details, but said more information would be available during next week’s quarterly earnings call. A G&W spokesman did not respond to a request for comment.

The partnership is a good strategic move for CP, which has lost market share at the Port of Vancouver to rival Canadian National. CN handles about 70 percent of the containers that move by rail to and from the port. With its larger footprint, CN can offer service to a wider number of destinations, including Indianapolis and Memphis, Tenn.

But CP has the shortest route from Vancouver to Chicago, an advantage it seeks to exploit. CP also is adding sales staff in Asia, with key positions being added in China and Singapore.

Providing a seamless interchange in Chicago will be one key to success of the new service.

“With the volume involved being to and from Asia, it won’t be tremendously service-sensitive but the service will need to be reliable,” says Larry Gross, an analyst with FTR Transportation Intelligence. “Having the ready source of outbound volume is certainly a plus, so the pacing item will be the ability to attract inbound volume.”

Norfolk Southern currently provides international intermodal service to Columbus, Ohio, from the west via connections with BNSF Railway, CN, and Union Pacific, primarily using run-through service via Ashland Avenue in Chicago.

Providing a seamless interchange in Chicago will be one key to the success of CP’s new service.

The CP alliance with the G&W railroads is reminiscent of the 2013 deal CN reached with the Indiana Rail Road to provide international intermodal service to Indianapolis from the ports of Vancouver and Prince Rupert, British Columbia.

From Chicago, the CP traffic will ride CF&E’s former Pennsylvania Railroad main line to Lima, Ohio, the connection with the IORY to Jeffersonville.

The addition of CP intermodal trains will diversify traffic on the G&W lines. The 281-mile CF&E currently handles chemicals, farm products, fertilizers, paper and steel, while the 469-mile IORY carries ethanol, farm products, fertilizers, lumber, paper and steel.

UPDATE: Additional comment from Larry Gross and information regarding Norfolk Southern service into Columbus, Ohio. A previous version of this story indicated that Ohio is under-served from the West. It is not. Oct. 13, 2017, 2:07 p.m. Central time.

Makes no sense.

Will this affect volumes at CSX/North Baltimore, OH, or the Schneider intermodal terminal at Marion, OH?

Making the old D T & I great again. Henry Ford would be proud.

I really like this move by Keith Creel and I think this move is a pretty solid opportunity although it will be interesting to see how much traffic there is at the outset. The big question I have is does this move perhaps signal a bigger move in the East by CPRS? I mean, it’s good to see that a portion of the former PRR Chicago – New York mainline now operated by CFE plays a big part here but will CSXT now under the choke-hold of EHH feel a need to divest itself of this portion that it now owns? And, if so, will CPRS see a need or desire to purchase it from CSXT and have CFE operate it for them? I don’t know but I’m guessing that the departed souls who rode the great PRR passenger trains of yesteryear such as the Broadway Limited, The General, The Pennsylvania Limited, et al, might be turning over in their graves right about now.

It’s interesting that CSX and NS don’t find this kind of interchange traffic (to their own IM terminals in Cincy or Columbus or Maryville or Marion) worthwhile. At least not from CP in Chicago where there likely isn’t an existing IM steel wheel interchange or the volume to start one. But G&W does.

Same for CN to Indy for that matter. They don’t interchange at Effingham for CSX to Indy, but instead go via INRD.